Foreign Currency Market

To buy foreign goods or services, or to invest in other countries, companies and

individuals may need to first buy the currency of the country with which they are

doing business. Generally, exporters prefer to be paid in their country’s currency

or in U.S. dollars, which are accepted all over the world.

When Canadians buy oil from Saudi Arabia they may pay in U.S. dollars and not in

Canadian dollars or Saudi riyals, even though the United States is not involved

in the transaction.

The foreign exchange market, or the FX market, is where the buying

and selling of different currencies takes place. The price of 1 currency in terms

of another is called an exchange rate.

The market itself is actually a worldwide network of traders, connected by telephone

lines and computer networks—there is no central headquarters. There are 3 main centers

of trading, which handle the majority of all FX transactions—United Kingdom, United

States, and Japan. Transactions in Singapore, Switzerland, Hong Kong, Germany, France

and Australia account for most of the remaining transactions in the market.

Trading goes on 24 hours a day during the weekdays. In the United States, trading

begins Sunday evening and ends on Friday evening. From Friday evening to Sunday

evening, most banks are closed throughout the world, and since banks are the main

traders and dealers of currency, there is very little activity over the weekends.

Indeed, trading activity in a particular currency and, hence, its liquidity, is

largely determined by how many banks are open that trade in that currency.

During the weekdays, trading progresses in waves as major banks open and close.

At 8 a.m. the exchange market is first opening in London, while the trading day

is ending in Singapore and Hong Kong. At 1 p.m. in London, the New York market opens

for business and later in the afternoon the traders in San Francisco can also conduct

business. As the market closes in San Francisco, the Singapore and Hong Kong markets

are starting their day. The foreign exchange market is a 24/5 market—most currency

trading occurs 24 hours per worldwide business day.

The trading week starts when Monday morning first arrives in New Zealand and ends

when it is late afternoon on Friday in San Francisco. Since New Zealand is just

across the International Dateline, it is still Sunday in most of the world when

it is Monday morning in New Zealand. So, for someone living on the east coast in

the United States, the currency markets start opening about 5 p.m. Eastern Standard

Time on Sunday.

The International Dateline is where, by tradition and fiat, the new

calendar day starts. Since New Zealand is a major financial

center, the forex markets open there on Monday morning, while

it is still Sunday in most of the world.

|

|

|

Source: United States Naval Observatory.

|

The FX market is fast paced, volatile and enormous—it is the largest market in the

world. In 2001 on average, an estimated $1.21 trillion was traded each day—roughly

equivalent to every person in the world trading $195 each day.

More statistics on the foreign

exchange market: Bank for International

Settlements: International Financial Statistics.

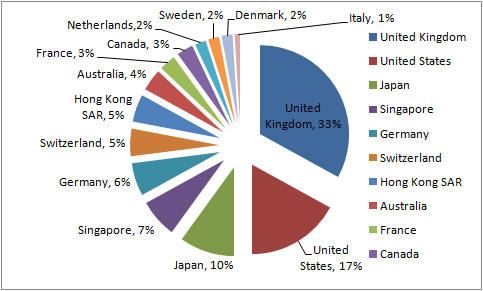

Percentages of FX Transactions by Country for April, 2001.

(Countries with less than 1% are not shown in the chart.)

|

|

|

Source: New York Federal Reserve Bank.

|

Foreign Exchange Market Participants

There are 5 types of market participants—banks, brokers, customers, retail forex

traders, and central banks.

- Banks and other financial institutions are the biggest participants. They earn profits

by buying and selling currencies among themselves. Roughly 2/3 of all FX transactions

involve banks dealing directly with each other.

- Brokers act as intermediaries

between banks. Dealers call them to find out where they can get the best price for

currencies. Such arrangements are beneficial since they afford anonymity to the

buyer/seller. Brokers earn profits by charging a commission on the transactions

they arrange.

- Customers, mainly large companies, require foreign currency in

the course of doing business or making investments. Some even have their own trading

desks if their requirements are large. Other types of customers are individuals

who buy foreign exchange to travel abroad or make purchases in foreign countries.

-

The Internet has allowed individuals to trade currencies using their home computers,

hoping to make a profit from speculation, and this is a growing, albeit small, percentage

of the trading volume.

- Central banks, which act on behalf of their governments,

sometimes participate in the FX market to influence the value of their currencies.

With more than $1.2 trillion changing hands every day, the activity of these participants

constantly affects the value of every currency in terms of every other.

Foreign Exchange Trading

Traders in the foreign exchange market make thousands of trades daily, buying and

selling currencies while exchanging market information. The $1.2 trillion that is

traded everyday may be used for varied purposes:

- For the import and export needs of companies and individuals;

- to hedge existing

positions;

- to profit from the short-term fluctuations in exchange rates;

-

for direct foreign investment;

- and to purchase foreign financial securities.

In the volatile FX market, traders constantly try to predict the behavior of other

market participants. If they predict the market correctly, they can profit from

it; otherwise, they'll probably lose.

Traders make money by purchasing currency and selling it later at a higher price,

or, anticipating that a currency is heading down, selling it short, then buying

it back at a lower price later.

To predict long-term movements of currencies, traders often use fundamental analysis

to try to determine whether the currency’s price reflects its fundamental value

in terms of current economic conditions of the involved countries and how those

economic conditions are changing. Examining inflation, interest rates, and the relative

strength of the countries' economies helps them make a determination. If they determine

that a currency is underpriced, then the trader will expect the price to rise, but

if it is overpriced, then the currency will probably decrease in value with respect

to another currency.

However, fundamentals are difficult to quantify and there are many variables to

consider, especially when the fundamentals of both countries of the currency pair

must be examined, which must be done to forecast their relative value. Furthermore,

fundamentals have a limited effect on price in the short term of most speculative

forex trades, which is measured in minutes or hours between the time when a trader

buys or sells and when she closes out her position. Hence, many traders use technical

analysis to try to determine future prices in the next few minutes or hours, or

sometimes, days. Technical analysis is the examination of recent prices and

trading volumes in the hope of seeing a chart pattern that, in the past, has led

to a certain change in prices more often than not. Although some traders use technical

analysis to predict long-term prices, long-term changes in prices will be dictated

by fundamentals.

Currency Trading Between Banks

Banks are a major force in the FX market and employ a large number of traders. Trading

between banks is done in 2 ways—through a broker or directly with each other.

Brokers

If a U.S. bank trades with another bank, a FX broker may be used as an intermediary.

The broker arranges the transaction, matching the buyer and seller without ever

taking a position and charges a commission to both the buyer and seller. About 1/3

of transactions are arranged in this way.

Direct

Mostly, banks deal with each other directly. A trader makes a market for another

by quoting 2 prices: the price at which he is willing to buy and the price at which

he is willing to sell. The difference between the 2 price quotes is the spread,

and is usually less than 10 pips. (1 pip = 1/10,000th of a currency

unit for most currencies.)

Most currencies are quoted in terms of how many units of that currency would equal

$1. However, the British pound, New Zealand dollar, Australian dollar, Irish punt

and the Euro are quoted in terms of how many U.S. dollars would equal 1 unit of

those currencies.

The currencies of the world’s large, industrialized economies, or hard currencies,

are always in demand and are actively traded. In terms of trading volumes, the FX

market is dominated by 4 currencies: the U.S. dollar, the Euro, the Japanese yen

and the British pound. Together these account for over 80% of the market.

It is not always easy to find a market for all currencies. The demand for currencies

of less developed countries, soft currencies, is a lot less than for the

hard currencies. Weak demand internationally along with exchange controls may make

these currencies difficult to convert.

Types of Transactions

There are different types of FX transactions: spot transactions, forwards, futures,

swaps, and options. Spot transactions are an immediate trade, while forwards, futures,

swaps, and options allow traders to manage risk or to profit from speculation over

an extended time period.

Spot Transactions

This type of transaction accounts for almost 1/3 of all FX market transactions.

Two parties agree on an exchange rate and trade currencies at that rate.

Example — Spot Transaction

- A trader calls another trader and asks for a price of a currency, say British pounds.

This expresses only a potential interest in a deal, without the caller saying whether

he wants to buy or sell. Otherwise, the other trader may skew her price in her favor

if she knew specifically what the other wanted.

- The second trader provides the

first trader with prices for both buying and selling (2-way price).

- When the

traders agree to do business, one will send pounds and the other will send dollars.

By convention the payment is actually made 2 days later, but next day settlements

are used as well, especially for the Canadian and U.S. dollar pair.

Although spot transactions are popular, they leave the currency buyer exposed to

some financial risks. Exchange rate fluctuations can effectively raise or lower

prices, making financial planning difficult for both companies and individuals.

Exchange Risks in Spot Transactions

Suppose a U.S. company orders machine tools from a company in Japan.

Tools will be ready in 6 months and will cost 120 million yen.

At the time of the order, the yen is trading at 120 to a dollar. The U.S. company

budgets $1 million in Japanese yen to be paid when it receives the tools (120,000,000

yen with 120 yen per dollar = $1,000,000) .

However, the yen per dollar rate will almost certainly be different 6 months later.

Suppose the yen per dollar drops to 100 yen per dollar:

Cost in U.S. dollars would increase (120,000,000 / 100 = $1,200,000) by $200,000.

Conversely, if the yen per dollar goes up to 140 yen to a dollar:

Cost in U.S. dollars would decrease (120,000,000 / 140 = $857,142.86) by over $142,000.

One alternative for a company is to pay for the foreign goods right away to avoid

the exchange rate risk, but this creates an opportunity cost equal to the interest

that could be earned on the money during the interim.

Forward Transactions

One way to deal with FX risk is to engage in a forward transaction. In this transaction,

money does not actually change hands until some agreed upon future date. A buyer

and seller calculate a forward exchange rate that depends on the current

exchange rate, the difference in interest rates between the 2 countries, and the

date on which the exchange will take place. The date can be a few days, months,

or years in the future, but in most cases, the time period is less than 1 year.

Because a forward contract is negotiated between the parties, it is customized to

their needs, especially in regard to the amounts involved and the date of settlement.

Since a forward transaction is a direct transaction between the buyer and seller

of currency in the over-the-counter (OTC) market, there is some credit risk that

one of the parties will default on the transaction.

Futures

Foreign currency futures are forward transactions with standard contract sizes and

maturity dates and are traded on organized exchanges. The buyer and seller of the

futures contract does not have to be concerned about the creditworthiness of the

other party, because the exchange becomes the intermediary of the transaction with

the seller selling to the exchange and the buyer buying from the exchange. The exchange

takes on the credit risk of the transaction. There is also greater price transparency

and liquidity, because there are many more traders for the standardized contracts.

Another advantage of futures over forwards is that a position in a futures contract

can be closed out before the settlement date by buying or selling the offsetting

contract. Because forwards are individually negotiated contracts, it would be difficult

for either party to offset their position.

Currency Swaps

The most common type of forward transaction is the currency swap. In a swap,

2 parties exchange currencies for a certain length of time and agree to reverse

the transaction at a later date.

Example — Currency Swap Transaction

Suppose a U.S. company needs 12 million Japanese yen for a 3 month investment in

Japan. It may agree to a rate of 120 yen to a dollar and swap $100,000 with a company

willing to swap 12 million yen for 3 months After 3 months, the U.S. company returns

the 12 million yen to the other company and gets back $100,000, with adjustments

made for interest rate differentials.

In all of these transactions, market rates might change. However, the buyer and

seller are locked into a contract at a fixed price that is not affected by any changes

in the market rates. A currency swap allows the market participants to plan more

safely, since they know in advance what their currency exchange will cost. It also

allows them to avoid an immediate outlay of cash.

|

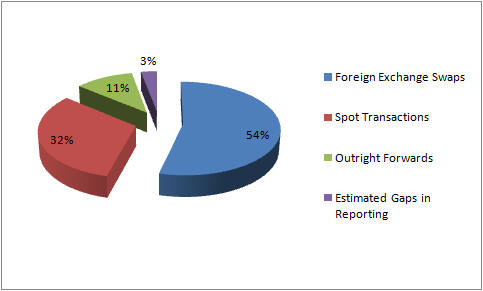

Percentages of FX Transactions by Type for April, 2001.

|

|

|

Source: New York Federal Reserve Bank.

|

Options

Most forwards and futures require performance at a specified time. An option

is similar to a forward or futures transaction, but it gives its owner the right,

but not the obligation, to buy or sell a specified amount of foreign currency at

a specified price, called the strike price, at any time up to a specified

expiration date. Options differ from currency futures because the option holder

can just let the option expire if, on the expiration date of the option, it is out

of the money. At the expiration of a futures contract, the futures buyer would have

to accept delivery of the currency, and the futures seller would have to actually

deliver the currency, unless it is a cash-settled contract, in which case the seller

would have to pay to the buyer the equivalent value in a specified currency.

A call option allows the holder to buy currency at the strike price. A put

option allows the holder to sell currency at the strike price.

Example — Option

Suppose a trader purchases a 6-month call on 1 million euros at 0.88 U.S. dollars

to a euro.

During the 6 months the trader can either purchase the euros at the 0.88 rate, or

purchase them at the market rate. After 6 months, the option expires.