Forex Trading

Understanding Forex Orders

One thing that you must understand about orders is that when you buy or sell short,

you are simply exchanging 1 currency for another. For instance, consider the Euro/dollar

currency pair, which is expressed as EUR/USD. (Short tutorial: Currency Quotes) EUR is the base currency

and USD is the quote currency. Since this is the most actively traded currency

pair, most brokers allow you to trade it. When you buy EUR/USD, you are exchanging

Euros for United States dollars, and when you sell this pair, you are doing the

opposite—exchanging dollars for Euros. Note that buying EUR/USD is the same as selling

USD/EUR, and vice versa. (You do not have to worry about having Euros in your account

to buy dollars—the broker will take care of this for you automatically.)

Buy EUR/USD ≡ Sell USD/EUR ≡ Exchange Euros for Dollars

Sell EUR/USD ≡ Buy USD/EUR ≡ Exchange Dollars for Euros

If you initiate a transaction by buying, then you are going long in the quote

currency and short on the base currency. If you initiate an order by selling the

currency, then you are going short the quote currency and long on the base

currency. Therefore, perforce, if you are long in 1 currency, you must be short

in the other.

To close a position, you must reverse the transaction that opened your position:

selling the currency you bought, or buying the currency you sold short.

Order Types

Most, if not all, brokers provide for basic order types that are similar to orders

for stocks.

Market Orders

The most common order is the market order, which is to buy or sell at market.

Actually, what this means is that you are buying the quote currency at the brokers

ask price or you are selling short at the brokers bid price, which

is always lower than the ask price. This is how most brokers make their money, and

why they do not need to charge commissions. The spread is the difference

between the bid and ask prices. In most cases, the most actively traded pairs will

have the smallest spreads, and less actively traded currency pairs will have larger

spreads. Spreads also increase when there is increased volatility in the market,

even for frequently traded currency pairs.

As soon as you buy or sell short, the spread is immediately subtracted from your

equity, because if you immediately closed the transaction even before there are

any price changes, then you will lose the amount of the spread.

The problem with the over the counter (OTC) market is that

there is no market price that is the same for all brokers, because there is no central

exchange where bid/ask prices can be compared. Most brokers average the quotes from

several large banks, but these quotes can differ depending on the bank. The forex

dealer then widens the spread for their own profit. This is the "market price"

that your broker quotes. This is true even for those brokerages that are advertising

a no-dealing desk, where your quote, supposedly, is seen directly by the

participating banks. However, the forex dealer is still widening the spread, for

that is how brokers make their profits.

Another problem with market orders is that some dealers may give a trader a very

unfavorable price that could be 10 pips or more removed from what the trader could

see using the broker's software, and then see the price go right back to where

it was. Sometimes, the broker will even requote the price, giving you a different

price from what you thought you bought it at. This doesn't happen often, but

if it does, you should find another broker.

Entry Limit Orders

An entry limit order is an order for a currency pair that is away from your

broker’s bid/ask price. In other words, your limit order to buy is not your broker’s

ask price, or your order to sell is not your broker’s bid price.

Your order does not compete with any other orders. Only your broker sees your order—no

one else. So there is little point in trying to place an order inside the spread,

where the transaction price—either a buy or a sell—is between the bid/ask price.

Many trading platforms do not even allow such an order to be entered, but even if

they did, the broker probably won’t complete the transaction unless the market moves

enough in the direction of your order.

There are some forex brokers who are advertising a no dealing desk, where

your order is shown to some banks that are in the broker’s network, and, in these

cases, the trading platform does allow you to place an entry limit order inside

the spread, but even this is not really effective, because only a few big banks

see your order, and if it is a small order, they probably won’t have much interest.

This is in contrast to an American stock exchange, where the best bid/ask prices

from all participants is displayed in the system, allowing just about anybody to

see those stock prices.

Closing Limit Order

There is another type of limit order that closes a transaction—the closing limit

order—and, often, it is listed simply as a limit order by the trading platform,

but this is an order to close a transaction that has already been initiated. If

the initial transaction was a buy, then the closing limit order will be a sell,

and vice versa. It is not necessary to specify whether to buy or sell, since this

will be determined by the initial transaction. It is only necessary to specify the

price.

Closing limit orders are set to take profits, so if the quote currency was purchased,

then the limit order will be higher than the purchase price; if the quote currency

was sold, then the limit order will be less than the sale price. If the broker’s

relevant bid or ask price never reaches your limit order, then no transaction will

be triggered, and your position will remain open until you change the limit price

or change it to a market order.

Stop-Loss Orders

It is very difficult to predict currency prices or monitor a 24-hour market, and

so brokers offer the stop-loss order type as a way for traders to prevent

major losses by being able to set a limit at an unfavorable price to close an open

position before the losses become too great. Because stop-loss orders are placed

to prevent more losses, they are set on the other side of the limit order to take

profits. Thus, a stop-loss order for a purchase transaction to sell is set below

the purchase price, and a stop-loss order to buy for a short transaction is set

above the sell price.

Because of the spread, a stop-loss order for a purchase transaction must be placed

below the dealer’s bid quote, which is lower than your purchase price at the time

of the transaction. In fact, it should be placed low enough so that the random walk

of market prices will not trigger your stop-loss order before your limit order.

Many traders try to avoid this by not setting a stop-loss order, but this is a mistake.

The market could move counter to your expectations for a long time or by a large

amount, resulting in very large losses, which are magnified by whatever leverage

you are using.

Since currency prices are so unpredictable, it is wise, and most trading platforms

allow it, to set both limit and stop-loss orders with the initial order, whether

it be a market or an entry limit order.

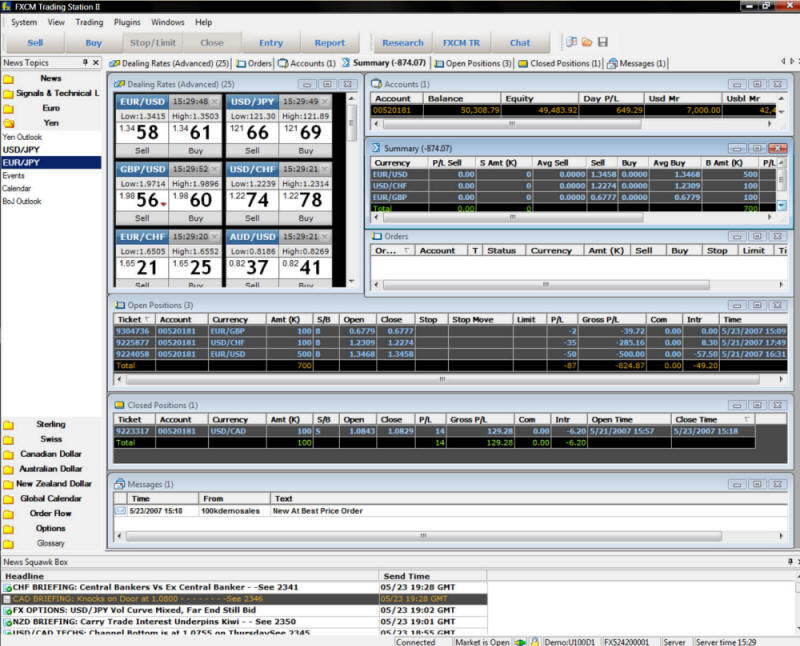

FX Trading Platform

The way to actually trade with most forex brokers is over the Internet using their

software—the trading platform. The mechanics of trading and what currency

pairs you may trade is determined by the software. In addition to trades, the software

usually provides other information about your account, such as your balance, how

much margin you have used, and how much you have left. It shows all open positions

along with any stops or limits for those orders, and any entry limit orders to initiate

a transaction. The software may also have windows for news and messages, and may

provide a chat service so that you can get help.

The best way to learn the software is to use it to manage a practice account, where

the broker allows you to trade using real market data, but without using real money.

Good software should prevent you from making at least some mistakes, such as accidently

entering a buy price that is higher than the market price, for instance, with similar

constraints in setting limit and stop orders. Otherwise, mistyping something, or

misusing the software can be a costly mistake.

Conclusion

In the stock market, you can set time limits on orders, such as good till canceled

(GTC), or day orders, which are good for the day. However, because

the forex market is a 24-hour market from Sunday afternoon until Friday afternoon,

most orders placed with brokers are GTC orders.

Before you start trading with real money, you should practice with a practice account

first. This is the best way to ensure that you not only understand the trading platform,

but also understand forex transactions. Otherwise, you could end up with large losses.

You should also trade long enough to see how well you do. Don’t jump into it just

because you did so well with a practice account in your 1st week. You

were probably just lucky. Although forex is very popular nowadays, and there is

a great deal of advertising promoting it, the fact is, it is very difficult to make

money trading currency—unless you’re a broker!